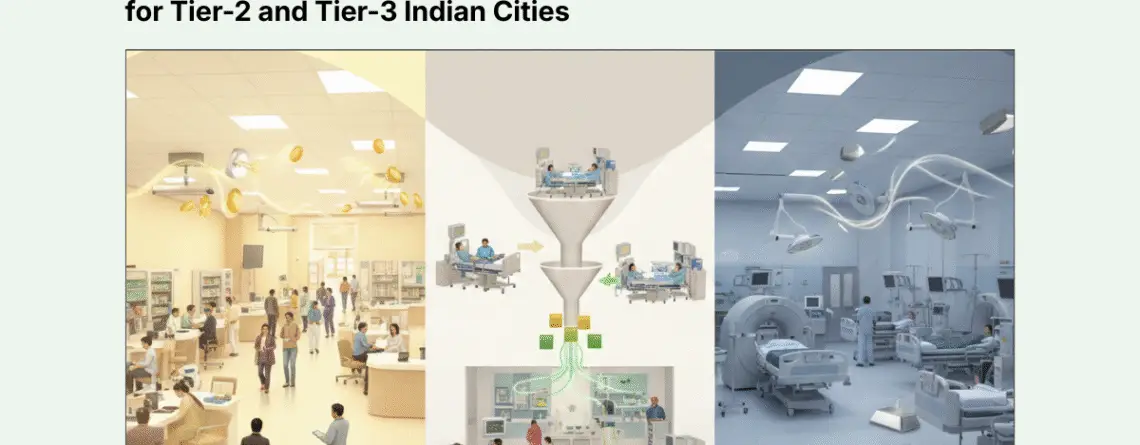

OPD-Driven vs IPD-Heavy Hospital Model: Financial Comparison for Tier-2 and Tier-3 Indian Cities

An IPD-heavy hospital model generates higher revenue per patient (₹50,000–₹2,00,000+ per admission) but requires significantly more capital and faces longer breakeven timelines (36–60 months). An OPD-driven model produces lower per-patient revenue (₹500–₹1,500 per visit) but delivers immediate cash flow and faster breakeven (12–24 months). For Tier-2 and Tier-3 Indian cities, the most financially viable strategy is a hybrid model: build a high-volume OPD engine to generate consistent cash flow and patient trust, then selectively develop 2–3 high-margin IPD specialties that can be fed by internal referrals. This approach optimizes asset utilization, reduces working capital stress, and balances growth with risk control.

Why This Decision Defines Your Financial Trajectory

In emerging markets like Raipur, Mysore, Udaipur, or Guntur, choosing between an OPD-driven or IPD-heavy hospital model is fundamentally a capital allocation and cash-flow management decision, not merely a clinical one.

The economic realities of Tier-2 and Tier-3 cities differ substantially from metros:

- Lower insurance penetration (though rising with Ayushman Bharat and state schemes)

- Higher price sensitivity and preference for out-of-pocket OPD consultations

- Delayed payment cycles for IPD (30–90 days from TPAs and government schemes)

- Limited specialist availability constraining IPD expansion

- Strong preference for local tertiary care if quality and trust can be established

These factors create distinct financial profiles for each model. Most hospital failures in smaller markets stem not from lack of demand, but from revenue model mismatch with local payment behavior and working capital capacity.

Revenue Economics: Volume vs. Value

The fundamental distinction lies in revenue architecture—how money is generated and when it is realized.

Table 1: Revenue Profile Comparison

| Parameter | OPD-Driven Model | IPD-Heavy Model |

| Average Revenue Per Case | ₹500 – ₹1,500 | ₹50,000 – ₹2,00,000+ |

| Primary Revenue Sources | Consultation fees, basic diagnostics (X-ray, lab), pharmacy, minor procedures | Surgical packages, room rent, ICU charges, advanced diagnostics (MRI, CT), implants, pharmacy |

| Billing Structure | Fee-for-service, predominantly | Package pricing for procedures + itemized billing for consumables |

| Payment Realization | Immediate (cash/UPI/cards) | Delayed: Cash patients 0–7 days, Insurance/TPA 45–120 days |

| Volume Dependency | Very high (need 80–150+ patients/day for viability) | Moderate (15–30 admissions/week can sustain operations) |

| Revenue Stability | Consistent but lower ceiling | Volatile but higher upside |

Critical Insight for Tier-2/3 Markets:

One successful knee replacement surgery (₹1,80,000) generates revenue equivalent to 120–360 OPD consultations. However, filling your IPD capacity requires either strong brand pull, established referral networks, or—most reliably—a robust internal OPD funnel that identifies and converts suitable cases.

In cities like Mysore or Raipur, 70–80% of first-time patients enter through OPD. They visit for routine consultations, chronic disease management, or diagnostic workups. Converting even 15–20% of this OPD volume into IPD procedures becomes the linchpin of a sustainable hybrid model.

The Hybrid Model: Strategic Rationale and Execution

The hybrid model is not a compromise—it is an intentional financial engineering strategy that addresses the weaknesses of both pure models.

How the Hybrid Engine Works

Phase 1: Establish OPD Dominance (Months 1–18)

Build a multi-specialty OPD with:

- 6–8 consultants across high-footfall specialties

- In-house diagnostics and day-care procedures

- Focus on brand building, patient database creation, and trust establishment

Financial Role: OPD generates positive cash flow within 9–15 months, covering operational expenses and reducing reliance on debt for working capital.

Phase 2: Launch Selective IPD (Months 12–24)

Add 20–30 beds focused on 2–3 anchor specialties with proven demand from OPD volumes:

High-ROI IPD Specialties for Tier-2/3 Markets:

- Ophthalmology: Cataract surgeries, refractive procedures (high volume, short stay, predictable outcomes)

- Orthopedics: Joint replacements, fracture management, sports injuries (high ticket, growing demand)

- Maternity and Neonatology: Deliveries, C-sections (consistent demand, cultural preference for hospital births)

- General Surgery: Laparoscopic cholecystectomies, hernia repairs, appendectomies

Financial Role: IPD contributes high-margin revenue while OPD cash flow cushions the IPD ramp-up period.

Phase 3: Optimize and Scale (Year 3+)

- Refine OPD-to-IPD conversion rates (target: 15–25% of eligible OPD cases)

- Add complementary specialties based on demand data

- Invest in advanced diagnostics (CT, MRI) only after IPD volumes justify utilization

Financial Advantages of the Hybrid Model

1. Optimized Asset Utilization

OTs and IPD beds are fed by a dedicated internal pipeline (OPD referrals), reducing dependence on visiting consultants or external referrals. This improves:

- OT utilization rates: 60–75% vs. 30–40% in IPD-only startups

- Bed occupancy: Predictable volume smooths seasonal variations

2. Working Capital Management

OPD’s immediate cash realization (T+0 to T+7) funds IPD working capital needs (inventory of implants, medicines) and buffers against delayed insurance payments (T+45 to T+90).

3. Lower Customer Acquisition Cost (CAC)

Converting an existing OPD patient to IPD costs far less than acquiring IPD patients through external marketing. The patient already trusts your facility and doctors.

4. Risk Diversification

Revenue is not dependent on a single stream. If elective surgeries decline (as during COVID-19), OPD consultations and diagnostics continue. If OPD footfall dips, IPD provides stability.

5. Competitive Moat

A thriving OPD creates patient loyalty and makes it harder for competitors or independent surgeons using rented OTs to bypass your facility.

Risk Matrix: What Can Go Wrong With Each Model

OPD-Only Model Risks

1. Margin Compression

- Intense competition from neighborhood clinics, diagnostic chains, and telemedicine

- Limited pricing power—patients easily switch for ₹50–100 differences

- Doctors may negotiate higher revenue shares as patient volumes grow

2. Scalability Ceiling

- Revenue is tied directly to clinician hours and physical space

- Cannot grow beyond 150–200 patients/day without significant space expansion

- Consultant availability becomes the bottleneck

3. Low Patient Stickiness

- Patients follow individual doctors, not the facility brand

- If a key consultant leaves, their patient base often follows

- Difficult to build institutional equity

4. Limited Defensibility

- Low barriers to entry for competitors

- Minimal regulatory moat (basic licensing vs. complex IPD approvals)

IPD-Heavy Model Risks

1. Extended Gestation and Cash Burn

- Typically requires 24–48 months to achieve 60%+ occupancy

- Negative cash flow during this period can exhaust reserves

- Many IPD-heavy startups fail due to working capital exhaustion, not lack of clinical capability

2. Working Capital Intensity

- High-value inventory tied up in implants, stents, surgical consumables

- Insurance reimbursements delayed by 60–120 days

- Creates a cash conversion cycle challenge

3. Specialist Dependency

- Hospital success tied to 3–5 key surgeons

- Losing a star consultant can immediately drop occupancy by 15–25%

- Recruitment challenges in Tier-2/3 markets

4. Regulatory and Compliance Burden

- Clinical Establishments Act, Fire NOC, Bio-Medical Waste Management

- NABH accreditation requirements for empanelments

- Significantly higher operational complexity than OPD

5. Fixed Cost Rigidity

- Cannot easily scale down during lean periods

- Empty beds still incur costs (staff, maintenance, utilities)

- Break-even occupancy pressure creates temptation to accept low-margin cases

Decision Framework: Choosing Your Model

Choose OPD-Driven Model If:

- Capital is less

- Target breakeven: 12–18 months

- Risk tolerance: Low to moderate

- Strength: Primary and secondary care, strong consultant networks

- Market maturity: Early-stage, building healthcare-seeking behavior

- Competitive advantage: Location, specific specialty expertise

Choose Hybrid Model (Recommended for Most) If:

- Capital is high

- Target breakeven: 48-60 months

- Risk tolerance: Moderate

- Strength: 2–3 strong clinical teams with proven track records

- Market maturity: Moderate—existing outflow to metros for tertiary care

- Competitive advantage: Can build both OPD trust and IPD clinical excellence

Choose IPD-Heavy Model Only If:

- Available capital: ₹70+ crores with 24-36-month cash buffer

- Target breakeven: 48–72 months acceptable

- Risk tolerance: High

- Strength: Exceptional clinical team with regional reputation

- Market maturity: High—proven demand for tertiary care locally

- Competitive advantage: Unique super-specialty positioning (e.g., cardiac surgery center, oncology institute)

Execution Roadmap: Phased Hybrid Development

For most healthcare entrepreneurs in emerging Indian markets, the recommended path is:

Year 1: OPD Foundation

- Launch with 6–8 specialty consultations

- Invest in strong diagnostics (digital X-ray, basic lab, ultrasound)

- Target: 70+ patients/day by Month 12

- Financial goal: Operational cash-flow positive

Year 2: Selective IPD Introduction

- Add 20–25 beds focused on 2 anchor specialties

- Build 1 modular OT, basic ICU (4–6 beds)

- Convert 10–15% of eligible OPD cases to IPD

- Financial goal: Overall profitability with OPD subsidizing IPD ramp-up

Year 3: Optimization and Growth

- Scale IPD to 40–50 beds based on proven demand

- Add 1–2 more specialties

- Invest in advanced diagnostics (CT, potentially MRI if volumes justify)

- Financial goal: 12–15% EBITDA margins, sustainable growth trajectory

This phased approach reduces initial capital outlay by 35–45%, allows you to test market demand with real data before committing to full IPD infrastructure, and significantly de-risks the most capital-intensive components.

Conclusion: Financial Realism Over Ambition

The choice between OPD-driven and IPD-heavy hospital models in Tier-2 and Tier-3 Indian cities is not about which is “better”—it is about which matches your capital capacity, risk tolerance, and market realities.

For most emerging markets:

- Pure OPD models offer safety and speed but limited upside

- Pure IPD models offer scale and prestige but extended risk and capital strain

- Hybrid models offer the optimal balance: OPD provides cash flow and patient trust, while selective IPD delivers profitability and asset utilization

The costliest mistake is building an IPD-heavy infrastructure without first establishing an OPD pipeline to feed it. This leads to underutilized assets, working capital stress, and extended breakeven timelines that exhaust promoter patience and capital reserves.

The winning strategy: Build OPD first. Prove demand. Let data guide IPD expansion. Scale only after utilization validates the investment.

For authoritative benchmarking, reference: Apollo Hospitals’ clinic-to-hospital referral model, Medanta’s hybrid tertiary care approach, CRISIL healthcare sector reports, and NABH infrastructure standards for day-care vs. inpatient facilities.

Leave a Reply