How to Choose the Right Bed Strength (100 vs 150 vs 250 Beds) for a New Hospital in Tier-2 Indian Cities

For most Tier-2 Indian cities, a 150-bed hospital delivers the optimal balance between initial capital efficiency, operational viability, and future scalability. However, this is not a universal formula. Your final decision must emerge from a rigorous analysis of five specific factors: local disease burden and specialty gaps, competitive landscape and patient outflow patterns, realistic financial modeling with Tier-2 cost benchmarks, manpower availability and regulatory requirements, and your risk appetite for phased versus immediate scale. A 100-bed facility often lacks the departmental critical mass needed for specialty profitability, while a 250-bed facility introduces excessive capital risk and extended break-even timelines that few promoters in emerging markets can sustain.

Why Bed Count Is Not a Vanity Metric

The most expensive mistake in hospital planning is treating bed strength as a prestige indicator. Too many doctor-investors frame their decision as: “The city needs a 250-bed hospital” or “We want to compete with the existing 200-bed chain.”

This is strategic malpractice.

In Tier-2 markets—cities like Nagpur, Lucknow, Visakhapatnam, or Coimbatore—profitability is determined by utilization rates and operational efficiency, not headline capacity. A 100-bed hospital consistently running at 75% occupancy generates superior returns and cash flow compared to a 250-bed facility struggling at 40% occupancy while burning capital on unused infrastructure, idle equipment, and excess staff.

The failure mode is predictable: Overcapitalized hospitals face 5–7 year break-even timelines, depleted working capital reserves, and eventual distress sales or stalled expansions. The discipline required is simple: Build for proven demand, not aspirational capacity.

The 4-Factor Decision Framework for Right Bed Strength

Factor 1: Catchment Analysis Beyond Population Metrics

Traditional feasibility studies rely on crude population-to-bed ratios. This is insufficient for Tier-2 hospital capacity planning in India. You need a three-dimensional analysis:

A. Disease Burden Mapping

Access district-level epidemiological data from:

- National Health Mission (NHM) health reports

- ICMR morbidity surveys

- Insurance claims data from TPAs operating locally

Identify high-incidence conditions:

- Non-communicable diseases (NCDs): Cardiac, diabetes, renal, oncology cases are rising at 12–15% annually in Tier-2 cities

- Trauma and emergency load: Road accident rates, industrial injuries

- Maternal and neonatal care gaps: Particularly in cities with inadequate government infrastructure

The treatment profile determines bed mix requirements. High cardiac or oncology burden demands fewer beds but higher-margin, technology-intensive departments (cath labs, radiation oncology). High maternity or orthopedic trauma volume requires bed turnover velocity and general ward capacity.

B. Patient Outflow Analysis

Interview 20–30 local general practitioners and conduct patient exit surveys at the district hospital. Determine:

- Which specialties are patients traveling to metros for? (Neurosurgery? Advanced cardiology? Oncology?)

- What is the approximate percentage of outflow? (30%? 50%?)

- What are the barriers to local treatment? (Lack of specialists? Outdated equipment? Trust deficit?)

Cities with 40–50% specialty outflow to metros represent significant capture opportunities—but only if you can credibly offer metro-equivalent clinical quality locally.

C. Competitive Landscape Audit

Don’t just count competitor beds. Evaluate:

- Occupancy rates (through informal medical community networks)

- Specialty strengths and weaknesses

- Reputational positioning (academic trust hospital vs. corporate chain vs. doctor-owned facility)

- Pricing tiers and payer mix

A market with two established 200-bed hospitals may still have space for a focused 100–150 bed super-specialty center if you identify an underserved niche (e.g., comprehensive cancer care or advanced orthopedics).

Factor 2: Why 150 Beds Emerges as the “Operational Sweet Spot”

The 150-bed configuration offers distinct strategic advantages in Tier-2 contexts:

Departmental Critical Mass

- Supports 4–6 strong specialty verticals (e.g., Cardiology, Orthopedics, Gastroenterology, Obstetrics, General Surgery, Critical Care)

- Justifies high-capital equipment investments: A cath lab requires 150–200 procedures annually to break even; a 150-bed hospital with dedicated cardiology can realistically generate this volume through internal referrals

Manpower Efficiency

- Can attract and retain 8–12 full-time specialists (feasible in Tier-2 markets)

- Achieves optimal nurse-to-patient ratios without the HR complexity of 250+ bed facilities

- Supports DNB (Diplomate of National Board) accreditation for 2–3 specialties, solving junior doctor staffing through academic programs

Empanelment and Institutional Credibility

- Meets minimum bed strength criteria for most insurance TPAs, government schemes (Ayushman Bharat), and corporate empanelments

- 100-bed facilities often face arbitrary exclusions from premium panels

Compared to 100 Beds: A 100-bed hospital struggles to justify dedicated specialty departments. For example, a neurosurgery program requires 24/7 ICU support, dedicated imaging, and surgical volume—difficult to sustain profitably at 100-bed scale.

Compared to 250 Beds: The 250-bed model demands metro-level patient pull, exceptionally deep referral networks, and the financial cushion to absorb 3–4 years of negative cash flow. Few Tier-2 markets can support this in Year 1–3.

Factor 3: When 100 Beds Actually Makes Strategic Sense

A 100-bed hospital is not inherently inferior—it is appropriate for specific scenarios:

Strong Candidate Scenarios:

- Niche Positioning: Single super-specialty focus (e.g., orthopedics and sports medicine, mother and child care, ophthalmology center of excellence)

- Secondary Care Emphasis: Cities where tertiary/quaternary care demand is limited but strong secondary care gaps exist

- Capital Constraints with Proven Practice: Doctor-entrepreneurs transitioning from successful 30–40 bed nursing homes

- Phased Growth Strategy: Intentionally starting lean with infrastructure designed for 150–200 bed expansion

The Non-Negotiable Requirement: If you build 100 beds, design and permit for 150–200 beds from Day 1. This means:

- Structural design allowing vertical expansion (foundation load capacity, elevator shaft provisions)

- Oversized central utilities (HVAC, medical gas, STP, electrical transformers)

- Land layout permitting horizontal expansion wings

- Fire and clinical establishment registrations accommodating future scale

This phased approach reduces initial capital risk by 30–40% while preserving upside optionality.

Factor 4: Regulatory and Manpower Realities

Clinical Talent Availability

Tier-2 cities face acute specialist shortages. A 250-bed hospital requires 25–30 full-time senior consultants. Can your city supply this? Or will you rely on weekly visiting consultants from metros—a model that compromises clinical governance and patient trust?

The 150-bed model aligns more realistically with local specialist pools while still offering meaningful clinical breadth.

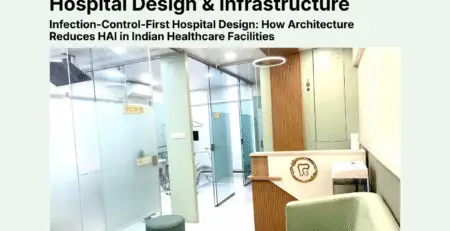

Accreditation Pathways

- NABH (National Accreditation Board for Hospitals): Achievable for all bed strengths but preparation complexity scales with size

- DNB Program Accreditation: Requires minimum bed strength and case volume thresholds by specialty; 150 beds comfortably meets most DNB requirements for 2–4 programs

- Clinical Establishments Act Compliance: Documentation and audit burden increases non-linearly beyond 200 beds

The Phased Growth Model: A Risk-Mitigation Strategy

For risk-averse promoters or first-time hospital investors, consider the 100→150 phased expansion model:

Phase 1 (Years 1–3): Commission 100 Beds

- Focus on 3–4 core departments with proven demand

- Achieve operational break-even and positive cash flow

- Build brand trust and referral networks

- Target: 70–75% average occupancy

Phase 2 (Years 4–5): Expand to 150 Beds

- Triggered by sustained occupancy above 70% for two consecutive quarters

- Add 1–2 new specialty verticals

- Upgrade diagnostic and critical care capacity

- Funding: Combination of operational cash flows and modest debt

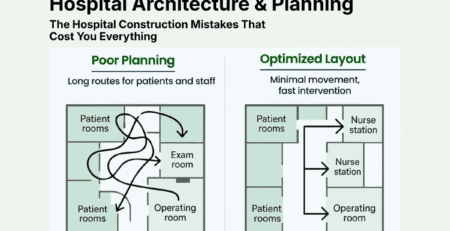

Design Prerequisites:

- Foundation and structure engineered for additional floors

- Central plant room (DG sets, chillers, compressors) installed with 40–50% excess capacity

- Plumbing risers and HVAC ducts roughed-in for future connections

- Modular OT and ICU design allowing incremental additions

Financial Impact: Phase 1 Capex typically 40–45% lower than immediate 150-bed build. Phase 2 expansion funded from operational cash flows reduces debt burden significantly.

Decision Checklist: Selecting Your Right Bed Strength

Before finalizing your bed count, verify these conditions:

Choose 100 Beds (Phased to 150) If:

- Limited capital availability (total project cost <₹70 crores)

- Strong single-specialty focus or secondary care emphasis

- Transitioning from existing smaller healthcare facility

- Market has high competitive density for general multi-specialty

- Manpower constraints for recruiting 10+ specialists

Choose 150 Beds If:

- Moderate-to-high patient outflow to metros (35–50%)

- Clear gaps in 3–5 specialty areas locally

- Capital availability of ₹85–130 crores

- Ability to recruit 8–12 full-time specialists

- Seeking insurance and corporate empanelments

- Desire for DNB accreditation in 2–3 specialties

Choose 250 Beds Only If:

- Exceptionally strong patient catchment (15+ lakh population with high NCD burden)

- Proven referral dominance or anchor corporate contracts pre-secured

- Capital reserves exceeding ₹200 crores with cushion for 48-month break-even

- Confirmed commitment from 20+ full-time specialists

- Plan to build a medical college or major academic institution

- Exit strategy targeting institutional investors or corporate acquisition

Conclusion: Let Data Drive the Decision, Not Aspiration

The right bed strength for a hospital in a Tier-2 city is not determined by competitor positioning, ego-driven expansion, or generic population formulas. It is the outcome of disciplined analysis: realistic demand assessment, honest financial modeling, manpower availability, and risk tolerance.

For most Tier-2 Indian cities, 150 beds or a phased 100→150 model represents the prudent path—sufficient scale to achieve operational efficiency and specialty depth, while maintaining manageable capital risk and break-even timelines.

The cost of getting this decision wrong is measured in years of financial stress, opportunity costs, and operational compromise. The investment in a rigorous feasibility study for hospital bed size—conducted by experienced healthcare consultants—is trivial compared to the consequences of building the wrong-sized hospital.

Next Steps: Commission a detailed catchment and financial feasibility study. Engage specialized healthcare architects and hospital planning consultants early. Make the bed strength decision based on evidence, not emotion.

For authoritative guidance, reference: NITI Aayog health infrastructure frameworks, National Health Systems Resource Centre (NHSRC) district health data, and healthcare sector reports from KPMG-FICCI and PwC India.

Leave a Reply